Home › My Account › About Online Banking

About Online Banking

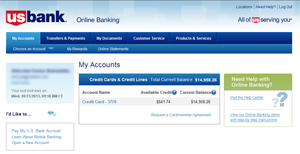

With U.S. Bank Online Banking, you'll enjoy many time-saving account management features, including:

- Expanded Transaction History – access up to 2 years of transactions – building to 5 years.

- Search Functionality – search through your transaction history by date, transaction type, description or amount.

- More Online Statements – over 2 years of Online Statements – building up to 7 years.

Account Transactions

With Online Banking, you have the flexibility to make a same-day payment, schedule a future payment or sign up for AutoPay, where your payment is scheduled on the same day each month. You can use a U.S. Bank checking account or an external account to make payments to your credit card. If you choose to set up an external payment account, it only needs to be set up once for all future payments.

To make a payment:

- Log in to Online Banking.

- Under the "Bill Payments" tab, select "Pay My Account" or "Pay a U.S. Bank Account".

- Select the Account you are paying, and the Account you are paying from.

- Select the frequency, either Once for a onetime payment, or Recurring to set up AutoPay.

- Complete the remaining payment information and select Continue.

- Review the payment details and click Submit.

- Print off the Confirmation Page for your records (you can also sign up to receive an email or text.)

The cut-off time for same day Web (non-AutoPay) payments varies but generally ranges between 5 pm and 8 pm CT. Please contact Cardmember Service if you have questions about your applicable cut-off time.

Or, you can make a payment using your mobile phone (see Mobile Banking below).

Get the most out of your card when you add additional authorized users to your account*. You’ll have peace of mind knowing that the people close to you have credit when they need it. Plus, you’ll experience more convenience and control when spend and transactions are all on one statement. It’s easy to do online – just follow these simple steps.

To add an Authorized User to your account:

- Log in to Online Banking.

- Under the "Customer Service", select "Self Service".

- Under the Credit Card Section, select "Add Authorized User".

- Provide the information requested and submit!

*Primary cardmember is liable for charges made by their authorized users.

To request a balance transfer:

- Log in to Online Banking.

- Select your Credit Card Account from the home page.

- Under the Payments and Limit section from the left navigation, select "Request a balance transfer".

- Select 'View Details' to display the balance transfer offer details.

- Click "Transfer a balance from another credit card."

Note: Rewards Points are not awarded for Balance Transfers.

Online convenience checks allow you to transfer balances or make payments to someone, and the amount will be billed to your Card. You can request that a booklet of checks be mailed directly to you.

To request convenience checks:

- Log in to Online Banking.

- Select your Credit Card Account from the home page.

- Select "Request a Convenience Check" from the left navigation.

- Follow the simple instructions to request a booklet of convenience checks.

Note: Rewards Points are not awarded for Convenience Checks.

With Online Banking, you can view your account balance and over two years of transactions. You can also view Online Statements, building up to 7 years of history.

To view Rewards Points earned:

- Log in to Online Banking.

- Under the My Accounts tab, select My Rewards

To request a credit limit increase:

- Log in to Online Banking.

- Select "Self Service" under the "Customer Service" tab.

- Select "Request a Credit Limit Increase".

- If you have multiple cards, select your desired account and click "Continue".

- Follow the easy steps to enter your information and submit your request.

We’ll immediately review your information and provide instant approval or information on next steps. You can also contact QFC Rewards World Elite Mastercard® Cardmember Service at 844-742-5809.

Account Preferences

Learn more about the benefits of going paperless.

Account Alerts notify you of important account activity, such as a low available balance or when a payment is due. You can set-up these alerts and select where you would like an email or text message notification delivered. Standard text messaging rates may apply from your mobile carrier.

The following alerts are available:

Transaction Alerts

- Suspicious Transaction

- Transaction Dollar Amount

- Credit Posted

- Debit Posted

- Card Not Present

- International Transaction

- ATM Cash Withdrawal

- Declined Transaction

- Gas Station Purchase

Statement and Payment Alerts

- Online Statement Available

- Payment Due

- Payment Overdue

- Payment Posted

Account Balance Alerts

- Available Credit

- Balance Exceeds Defined Amount

To set up Account Alerts:

- Log in to Online Banking.

- Select "My Alerts" under the "Customer Service" tab.

- Click "Add Alerts" next to your Card account.

Security Alerts notify you when sensitive personal information like an ID or address changes. These alerts do not require any set-up and are automatically delivered to your primary email address.

You will be notified when the following events occur:

- Address or phone number changes

- Primary email address changes

- Online Banking ID or Password changes

- Online Banking ID and Password were disabled due to multiple, incorrect login attempts

- Login Assistance was requested to provide your Online Banking ID

- ID Shield Changes (including setup, questions and answers or image/sound and phrase changes)

How to change where Security Alerts are delivered

To change your primary email address:

- Log in to Online Banking.

- Select Edit Profile under your name and email address.

- Click "Edit" next to Primary Email information.

Mobile Banking

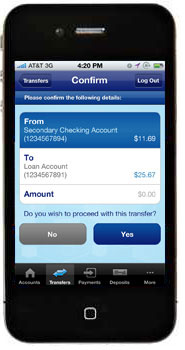

Always have your bank at hand. Get the convenience of banking anytime, anywhere with the U.S. Bank Mobile App for iPhone!1

- Make a payment - Pay your QFC Rewards World Elite Mastercard® monthly payment.

- Stay in control of your money - Check balances, review transactions and transfer money between U.S. Bank accounts -- safely and securely.

Get the App Now:

- Scan the bar code to download the application.2

- Visit the app store on your phone and search for “US Bancorp”.

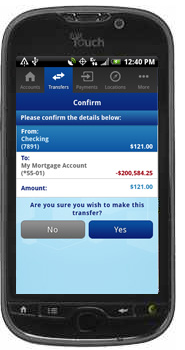

Always have your bank at hand. Get the convenience of banking anytime, anywhere with the U.S. Bank Mobile App for Android!1

- Make a payment - Pay your QFC Rewards World Elite Mastercard® monthly payment.

- Stay in control of your money - Check balances, review transactions and transfer money between U.S. Bank accounts -- safely and securely.

Get the App Now:

- Scan the bar code to download the application.2

- Visit the app store on your phone and search for “US Bank Mobile”.

If your phone can access the web, you can enjoy the convenience of mobile banking.1 Just type m.usbank.com into any Web-enabled mobile phone, then log in with your Personal ID and Password.

- Make a payment - Pay your QFC Rewards World Elite Mastercard® monthly payment.

- Stay in control of your money - Check balances, review transactions and transfer money between U.S. Bank accounts -- safely and securely.

Getting Started

Type m.usbank.com into any Web-enabled mobile device, then log in to US Bank Mobile Banking.

Additional Features

To request a copy of your Cardmember Agreement:

- Log in to Online Banking.

- Select "Self Service" under the "Customer Service" tab.

- Select "Manage My Accounts".

- Click on "QFC Rewards World Elite Mastercard®."

- Select "Request A Cardmember Agreement" and follow the easy steps to submit your request.

Your Agreement will be mailed to you within 7-10 business days.

It's easy to download your transaction data into Quicken® or Microsoft® Excel formats.

To download transaction data:

- Log in to Online Banking.

- Select your Credit Card account from the home page.

- Select "Download" in the middle section after the Credit Card Overview.

- Select the date range.

- Select the download file type.

- Click "Download".

California Privacy Center

We use technologies, such as cookies, that gather information on our website. That information is used for a variety of purposes, such as to understand how visitors interact with our websites, or to serve advertisements on our websites or on other websites. The use of technologies, such as cookies, constitutes a 'share' or 'sale' of personal information under the California Privacy Rights Act. You can stop the use of certain third party tracking technologies that are not considered our service providers by clicking on "Opt-out" below or by broadcasting the global privacy control signal.

Note that due to technological limitations, if you visit our website from a different computer or device, or clear cookies on your browser that store your preferences, you will need to return to this screen to opt-out and/or rebroadcast the signal. You can find a description of the types of tracking technologies, and your options with respect to those technologies, by clicking "Learn more" below.

We were unable to retrieve your Refer a Friend Referral Code which is needed to submit a referral. Please try again and ensure that your first name, last name and last 4 digits match what is on your credit card. If you receive this error again you can contact Cardmember Services and they can assist by calling 844-742-5809